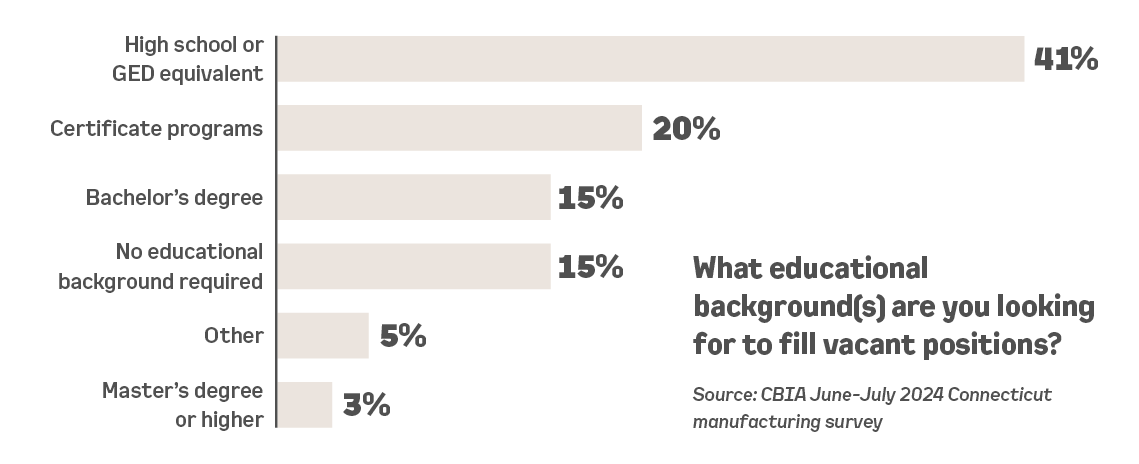

Manufacturing has been an integral part of Connecticut’s economy for well over 200 years and it is a critical part of our future, providing well-paying career opportunities to our citizens with a wide spectrum of educational backgrounds—from high school graduates to PhDs.

Today, manufacturing ranks as Connecticut’s second-largest industry sector — just behind finance and insurance. Manufacturing wages are significantly above the state average, and the vast majority of Connecticut manufacturing jobs provide healthcare and additional benefits.

When one considers the pay and benefits, the variety of available occupations, and the advancement opportunities presented to new workforce entrants as our older workers retire, it underscores the adage that, “Manufacturing provides more than good jobs, manufacturing provides great career opportunities.”

An Overview of CT Manufacturing

61%

of Companies have fewer than 50 employees

4591

total Companies in CT

$15.67B

annual wages paid

$100745K

average wages

153600

manufacturing employees

5

additional jobs created for every manufacturing job

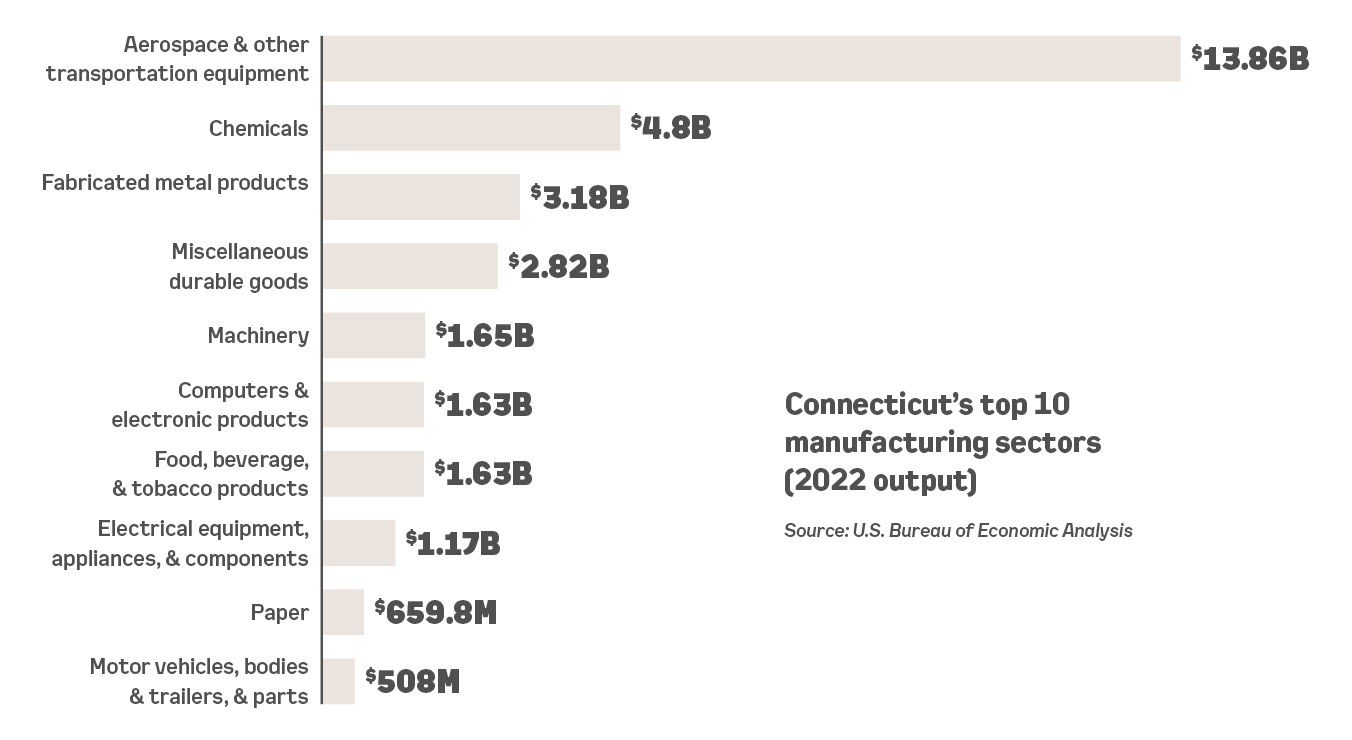

Connecticut’s long-standing reputation for manufacturing ingenuity and innovation remains central to the state’s economy. From the invention of the helicopter and the submarine to breakthroughs like anesthesia, the Polaroid camera, and household names like the Frisbee and Wiffle Ball, the state has a long history of shaping industry sectors and everyday life.

As of August 2025, Connecticut manufacturers employed 153,600 people representing 10.4% of the state’s total private sector workforce.

Workforce & Hiring

The need to grow Connecticut’s manufacturing workforce cannot be understated, and neither can the barriers hampering hiring efforts across the state.

Executives cite lack of work ethic (26%), wage expectations beyond their budgets (19%), competition from other employers offering higher wages (15%), and the state’s high cost of living in Connecticut as major barriers.

To address hiring challenges, many manufacturers are making targeted investments in their workforce. Twenty percent reported investing in internships and apprenticeships, while others are adopting policies such as flexible paid time off (16%), flexible work schedules (12%), tuition reimbursement (10%), employee engagement and recognition programs (13%), and shifting requirements from education based to skills-based qualifications (11%). Smaller shares reported offering sign-on or stay-on bonuses (4%), remote or hybrid options (4%), and student loan assistance (1%).

82%

of manufacturers report difficulty finding and retaining workers with skills gaps the top barrier

45%

say job applicants do not possess the required skills

39%

of manufacturers seek for applicants with a high school or GED equivalent diploma

A WORKFORCE SOLUTION

To help address the workforce issue, the Manufacturing Innovation Fund board allocated $4,264,745 million over two years to support the expansion of K-12 robotics programs across the state under the direction of ReadyCT in partnership with NE FIRST and REC.

For more information, contact [email protected].

Information on this page was excerpted from the 2025 Connecticut Manufacturing Report, produced by CBIA and affiliates CONNSTEP and ReadyCT – made possible through the generous support of RSM.

The information and data shared in this report came from multiple sources, including a comprehensive June-July CBIA survey of manufacturers, numerous state and federal agencies, and interviews with public and private manufacturing leaders.