Manufacturing has been an integral part of Connecticut’s economy for well over 200 years and it is a critical part of our future, providing well-paying career opportunities to our citizens with a wide spectrum of educational backgrounds—from high school graduates to PhDs.

Today, manufacturing is one of the top four employment sectors in Connecticut and each manufacturing job supports more than three other jobs, according to most studies. Manufacturing wages are also significantly above the state average, and the vast majority of Connecticut manufacturing jobs provide healthcare and additional benefits.

When one considers the pay and benefits, the variety of available occupations, and the advancement opportunities presented to new workforce entrants as our older workers retire, it underscores the adage that, “Manufacturing provides more than good jobs, manufacturing provides great career opportunities.”

Read the entire CT Manufacturing Report, produced by CBIA and affiliates CONNSTEP and ReadyCT.

An Overview of CT Manufacturing

72%

of Companies have fewer than 50 employees

4548

total Companies in CT

$14.7 B

annual wages paid

$92633K

average wages

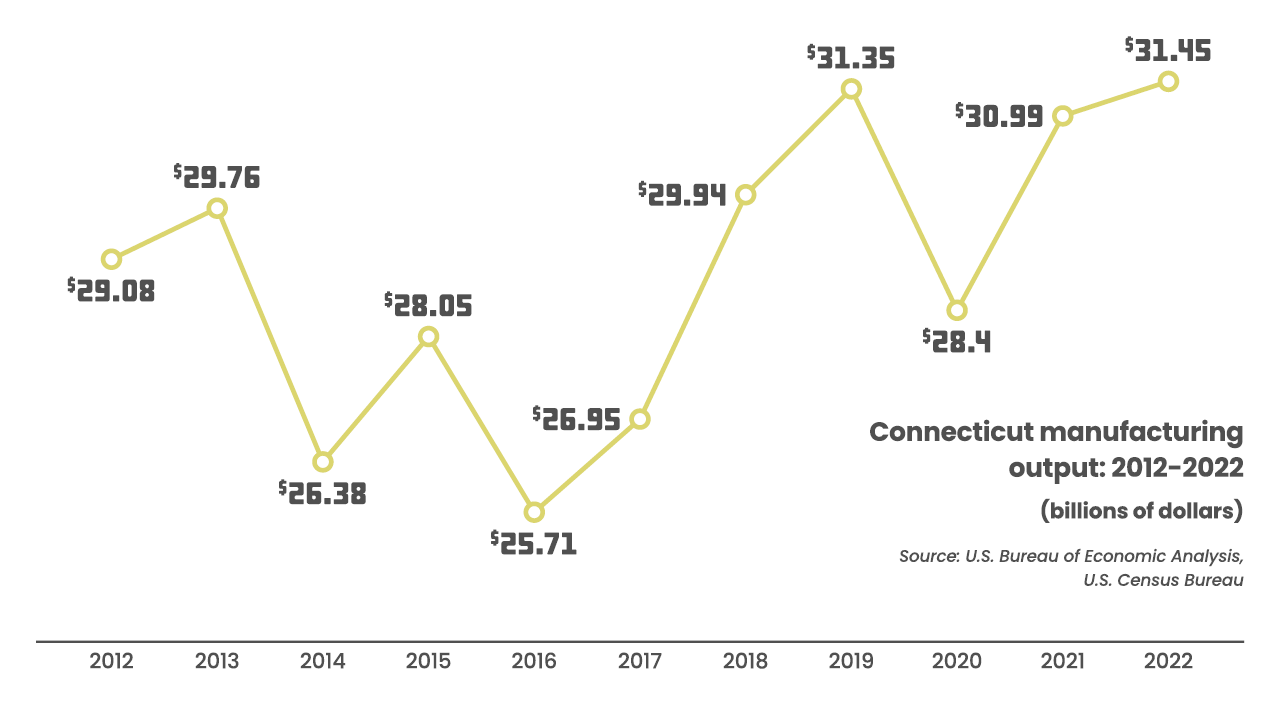

$31.45B

contributed to the state’s economic output in 2022, including $15.3B in exports

5+

additional jobs created for every manufacturing job

The state’s 4,48 manufacturers are generally well-established companies with a commitment to growth and economic stability. Based on CBIA’s 2023 survey, the average manufacturer has operated for 73 years, with 80% in business for 20 or more years.

Seventy-two percent are small businesses with less than 50 employees, while 28% employ 50 or more workers. Twenty-one percent are family-owned businesses, 7% women-owned, and 4% are veteran-owned.

As of August 2023, the state’s 4,548 manufacturers employed 157,600 workers and paid $14.7 billion in annual wages and benefits. That represents an average salary of $92,633, 14% higher than the state’s average wage of $81,237. Most critically, the sector drives other parts of the state’s economy, creating up to 5 additional jobs for every manufacturing job and generating $2.60 in additional economic activity for every dollar spent.

Workforce & Hiring

Connecticut has one of the best-developed workforce development systems in the country. However, the state’s shrinking labor force–down 41,300 people (-2.1%) since February 2020–is undermining the sector’s outlook as job openings surge.

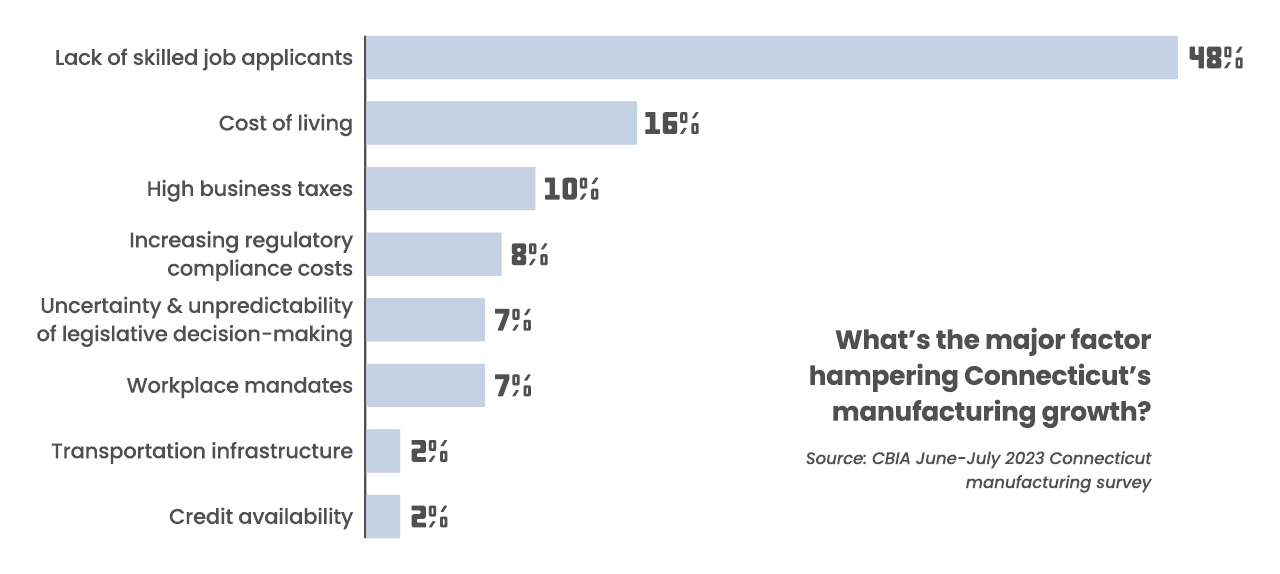

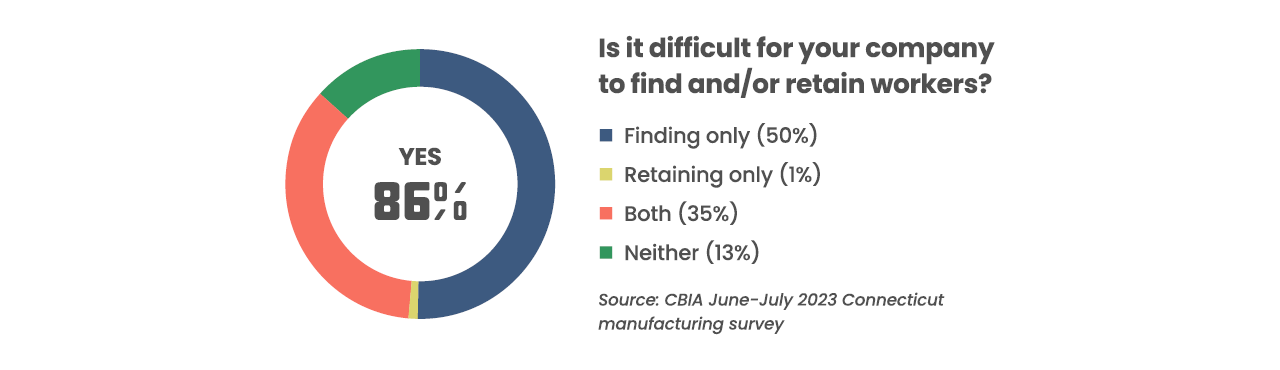

Connecticut manufacturers say it is difficult to find and retain workers and 48% describe the labor shortage as the biggest obstacle hampering growth. Twenty-nine percent of surveyed manufacturers say applicants do not possess the required skills or expertise and 26% were concerned with a perceived lack of work ethic, with prospective employees lacking reliability and productivity. The largest share of manufacturers (41%) are looking for applicants with a high school or GED equivalent diploma.

One manufacturer suggested that state legislators “work with the education system to provide training or exposure to manufacturing for young people. We need [talented and hard-working] young people to see the opportunities in our industry.” The CT Manufacturing Careers Roadshow series, led by ReadyCT with resources provided by the Manufacturing Innovation Fund, is an example of a statewide effort to introduce middle/high school students to today’s modern, high-tech manufacturing careers. Other suggestions include more career-connected high school coursework, tax incentives for small manufacturers, comprehensive job certification programs, and improved perceptions of careers in the skilled trades.

86%

of manufacturers have difficulty finding and/or retaining employees

29%

say job applicants do not possess the required skills

41%

of manufacturers seek for applicants with a high school or GED equivalent diploma

Information on this page was excerpted from the 2023 Connecticut Manufacturing Report, produced by CBIA and affiliates CONNSTEP and ReadyCT – made possible through the generous support of RSM.

The information and data shared in this report came from multiple sources, including a comprehensive June 12- July 17 CBIA survey of manufacturers, numerous state and federal agencies, and interviews with public and private manufacturing leaders.